New Road BCI Global Flexible Fund of Funds

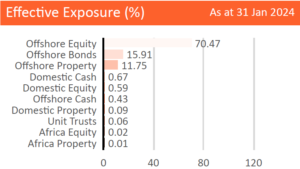

The New Road BCI Global Flexible FoF is designed as a satellite portfolio for clients who would like additional offshore exposure in their portfolios without having to physically take their money offshore. The fund has a flexible mandate, meaning that it can vary widely in its exposure to the various offshore asset classes over time. This portfolio can also be used as a core portfolio for advisers whose clients are only looking for offshore exposure in their investments.

The fund is priced in Rands, however due to the offshore nature of the underlying investments, currency fluctuations will add to short term volatility. The focus is therefore on long-term capital growth.

This fund falls within the following ASISA Category:

Global Multi-Asset Flexible